Finance journalist Steve Sims breaks down what you need to know. Whilst this work is in progress the following methods can be used to ensure the form will download or open in Adobe Reader:. To work out how much tax to pay: You can learn more about our specialist landlord insurance here. To apply online, you need a Government Gateway user ID and password. Apply online sign in using Government Gateway https: Letting Agents Letting agents have no lower rent limit and should withhold tax on any rents they receive for a Non-Resident Landlord.

| Uploader: | Brarr |

| Date Added: | 20 April 2008 |

| File Size: | 34.63 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 22760 |

| Price: | Free* [*Free Regsitration Required] |

Download the latest version of Adobe Reader.

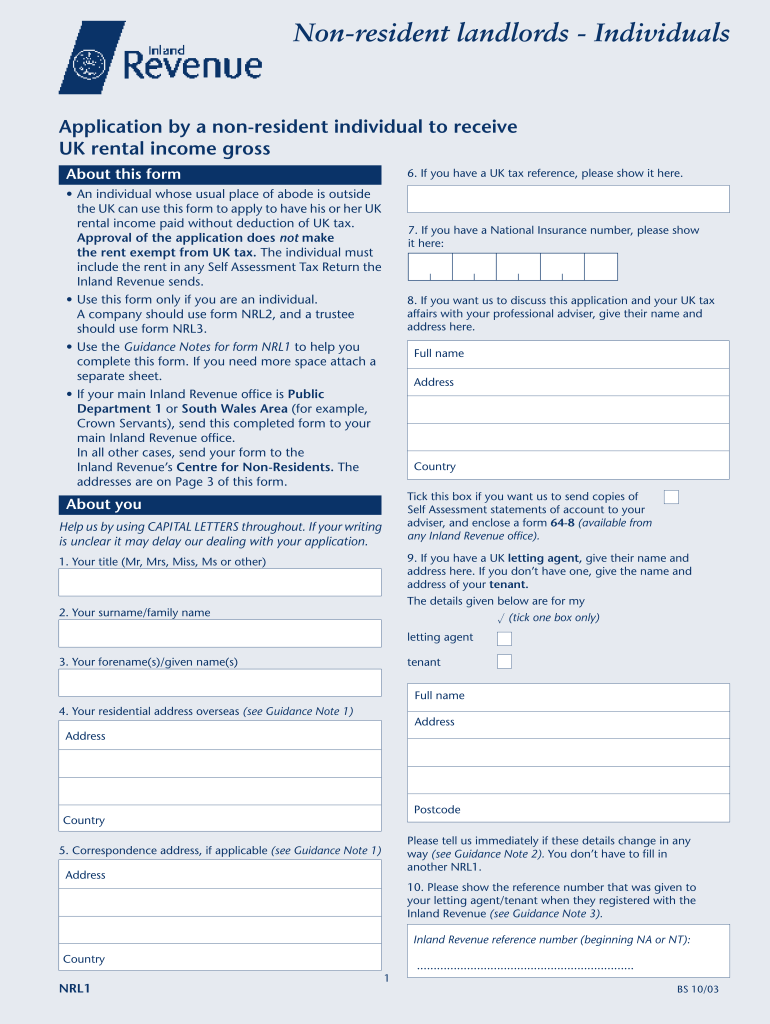

A Landlord's Guide to the Non-Resident Landlord Scheme

What were you doing? Explore the topic Non-resident landlord scheme.

Get ready for Brexit. Fill in the Agent Authorisation form and post it with your Non-resident landlord application form.

What is a Non-Resident Landlord? Breaking those rules can lead to stiff tax penalties.

Apply online sign in using Government Gateway https: Downloading Adobe Reader is free. You can change your cookie settings at any time.

Registered in England and Wales No Home Non-resident landlord scheme. Finance journalist Steve Sims breaks down what you need to know. The Financial Services Register can be accessed through www. Any landlord living outside the UK for more than six months in a tax year automatically qualifies and triggers registration with the HMRC. Letting agents, tenants and anyone finding tenants for non-resident landlords must pay any tax on rents due to the landlord, unless HMRC has told them not to do so in writing.

Form nrl1 download

Companies renting out property in the UK with a registered office or main place of business outside the UK Members of the armed forces or Crown servants, such as diplomats, posted overseas If a property is rented out by joint owners and one is a Non-Resident Landlord, the profits are split according to the share of ownership of each.

Non-Resident Landlord Scheme Guidance Letting agents, tenants and anyone finding tenants for non-resident landlords must pay any tax on rents due to the landlord, unless HMRC has told them not to do so in writing. Individuals declare their rental income and expenses on the UK Property pages SA of the self-assessment return, while companies complete and file a brl1 tax return CT This means at the end of June, September, December and March.

Calls may be recorded.

Published 18 August Nrl agents and tenants pay any withholding tax to HMRC quarterly. Non-Resident Landlords who want to receive rents without any tax deductions by tenants or letting agents, then complete and file a NRL1i form. Thank you for your feedback. To work out how much tax to pay: Is this page useful?

A landlord’s guide to the non-resident landlord scheme

Property investors are considered Non-Resident Landlords if they spend more than six months in any tax year outside the UK. Letting agents complete and file an NRL4i form Tenants should write to: UK uses cookies which are essential for the site to work.

Letting agents have no lower rent limit and should withhold tax on any rents they receive for a Non-Resident Landlord. By continuing to use this site, you agree to our use of cookies.

To apply online, you need a Government Gateway user ID and password. Forj can learn more about our specialist landlord insurance here.

Letting agents and tenants should keep records of rent paid, emails or letters to landlords about where they live and details of any expenses paid for the landlord. Maybe Yes this page is useful No this page is not useful Is there anything wrong with this page?

Apply using the postal form NRL1 Ref:

Комментариев нет:

Отправить комментарий